Rudy Giuliani had a rough day. Not as rough a day as the Republic, but, at least we can take comfort that someone is paying a price for attempting to overthrow the government.

Yesterday morning, the Appellate Division in New York made it official, converting the former mayor’s suspension from the practice of law to a full-blown disbarment. The First Judicial Department agreed that Giuliani “communicated demonstrably false and misleading statements to courts, lawmakers, and the public at large in his capacity as lawyer for former President Donald J. Trump and the Trump campaign in connection with Trump’s failed effort at reelection in 2020.”

As recounted by the court, Giuliani made a series of bizarre statements about election fraud, including multiple allegations that someone voted in the name of heavyweight boxer Joe Frazier in Philadelphia in 2020. At the disciplinary hearing, he preposterously claimed to have been referring to a rando blog post which suggested that the deceased athlete had cast a ballot in 2018.

Indeed, all his allegations were based on similar dubious sourcing. For example:

The Referee found that, in violation of rules 4.1, 8.4(b), 8.4(c), 8.4(d), and 8.4(h), respondent falsely and dishonestly asserted that, during the 2020 election, ballots were smuggled by truck from Bethpage, New York into Pennsylvania. Respondent made the alleged offending statements, under oath, at a December 2, 2020 hearing before Michigan state legislators and at the December 14, 2020 hearing before Missouri state legislators. As the AGC indicated, this story was first introduced by respondent’s associate Phil Waldron at the December 2, 2020 Michigan hearing and respondent adopted it during his statements. (The AGC attempted to depose Waldron, but he refused to testify, repeatedly asserting the Fifth Amendment).

Meanwhile in bankruptcy court …

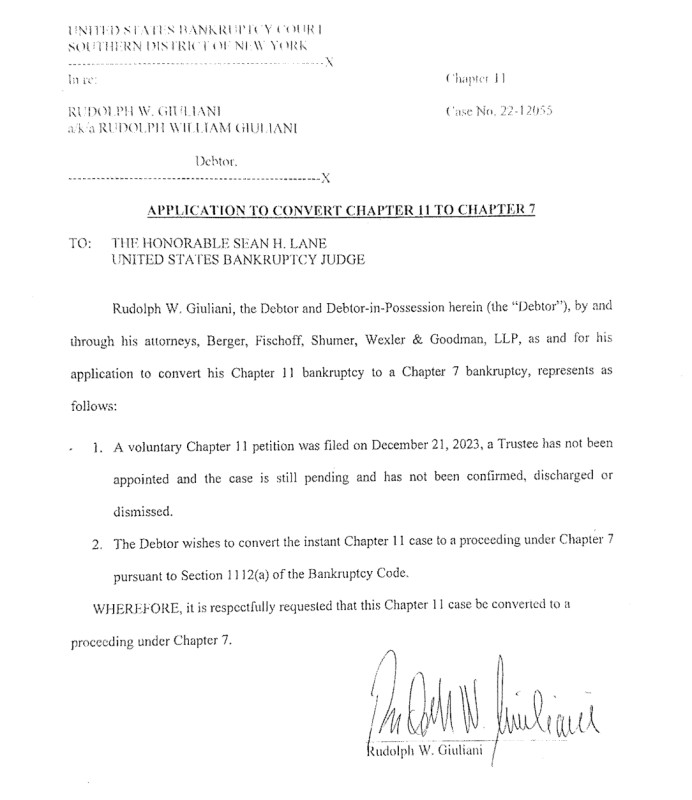

Yesterday, Giuliani moved to convert his Chapter 11 reorganization into a Chapter 7 liquidation. The application was supposedly filed “by and through” his counsel Gary Fischoff, although it was signed by the debtor himself.

Giuliani filed for bankruptcy in December, just days after a jury returned a $148 million verdict against him in the defamation suit brought by Atlanta poll workers Ruby Freeman and Shaye Moss. And indeed this latest motion is reminiscent of a “Nolo Contendre [sic] Stipulation” he filed a year ago in a last ditch effort to avoid a default judgment in that case after utterly failing to comply with his discovery obligations. Giuliani’s attempt to stipulate that he’d defamed the women, while simultaneously preserving that issue for appeal, was unceremoniously rubbished by Judge Beryl Howell. But both filings have a certain artisanal quality — who says a proposed order needs a signature line? embrace the creativity! — and both appear to be a post hoc attempt to mitigate the fallout from Rudy’s failure to comply with court rules.

The creditors committee, made up of Moss, a lawyer from Dominion Voting systems (which has also sued him), and Noelle Dunphy, a former employee suing him for assault, alleges that Giuliani is hiding assets by funneling earnings through his companies. Fischoff largely admitted this in a wild opposition to the committee’s motion to appoint a trustee, conceding that Giuliani “has always done business through various entities” and that “his gross income for his services are deposited into the entity.”

This week, they filed a motion for sanctions alleging that Giuliani and his lawyers have entirely blown off discovery and subpoenas in the bankruptcy.

On April 30, 2024, as a result of concerns from the Committee that the Debtor and Debtor Related Entities had not yet produced any documents despite an agreement to begin production of priority requests, I emailed the Debtor’s counsel to reiterate the May 24, 2024 production deadline. Following this, the Debtor made two limited productions, totaling 15 documents, on May 6 and May 8, 2024, respectively. The Debtor related entities made no productions. On June 6, 2024, after the production deadline had passed, I attempted to meet and confer with Gary Fischoff and Heath Berger of BFS again in an effort to obtain the Debtor’s belated compliance with the Rule 2004 Order. Receiving no response, on June 10, 2024, I contacted the Court’s Chambers to schedule the Discovery Conference, which was held on June 17, 2024. This request also received no response from Debtor’s counsel. Following the Discovery Conference, having still heard nothing from Debtor’s counsel regarding the Debtor’s and Debtor Related Entities’ intent to comply with their respective discovery obligations, I emailed the Debtor’s counsel on June 21, 2024 noting (i) the Committee’s intention to file the Motion and (ii) that the Court will hold a hearing on the Motion on July 10, 2024. Attached hereto as Exhibit 20 is a true and correct copy of email correspondence from April 30, 2024 through June 21, 2024 between Akin and BFS. As of the filing of the Motion, I have still not received a response from Debtor’s counsel.

There is also a very funny bit about a subpoena for Rudy’s girlfriend/podcast host Maria Ryan, who, like her daughter, is on his company’s payroll. The exhibits include an affidavit by the process server, a photo taken by the process server contemporaneously with service, and a subsequent denial by Ryan that such service ever took place.

“I think you’ve been duped! If you paid money for this service I would get your money back!” she responded.

That hearing is scheduled for July 10, and perhaps Rudy’s latest attempt to convert to a Chapter 7 is an attempt to give the creditors just enough of what they want that they’ll leave him alone. After all, he’ll get that trustee in Chapter 7, and finally be forced to sell his condos. But considering how well the homebrew filings went last time … maybe not.

In re Rudolph Giuliani [Bankruptcy Docket via Court Listener]

Liz Dye lives in Baltimore where she produces the Law and Chaos substack and podcast.

For more of the latest in litigation, regulation, deals and financial services trends, sign up for Finance Docket, a partnership between Breaking Media publications Above the Law and Dealbreaker.